Expert Insights on CRF Clinical Research Practices

Comprehending the best practices in clinical research is the best way to evolve and be updated to participate in the ever-transforming realm we are part

Ready to get started building the right eClinical solution for your trial?

Integrated solutions encompassing EDC, eCOA/ePRO, eCRF, and eConsent for non-interventional studies, Real-World Evidence (RWE), and successful launches. Enhance communication with healthcare professionals by providing real-time clinical data insights into study progression.

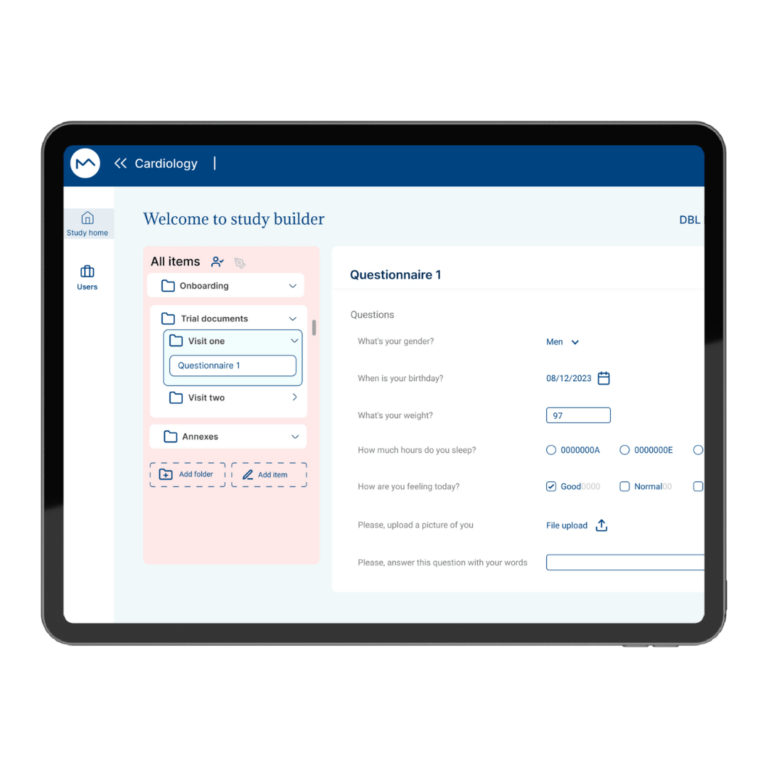

Milo ePRO automatically provides the necessary audit trail traceability for compliance with clinical trial regulations. Mandatory fields, edit checks, input-dependent paths, and automated validations further enhance the quality of data, ensuring accuracy and reliability.

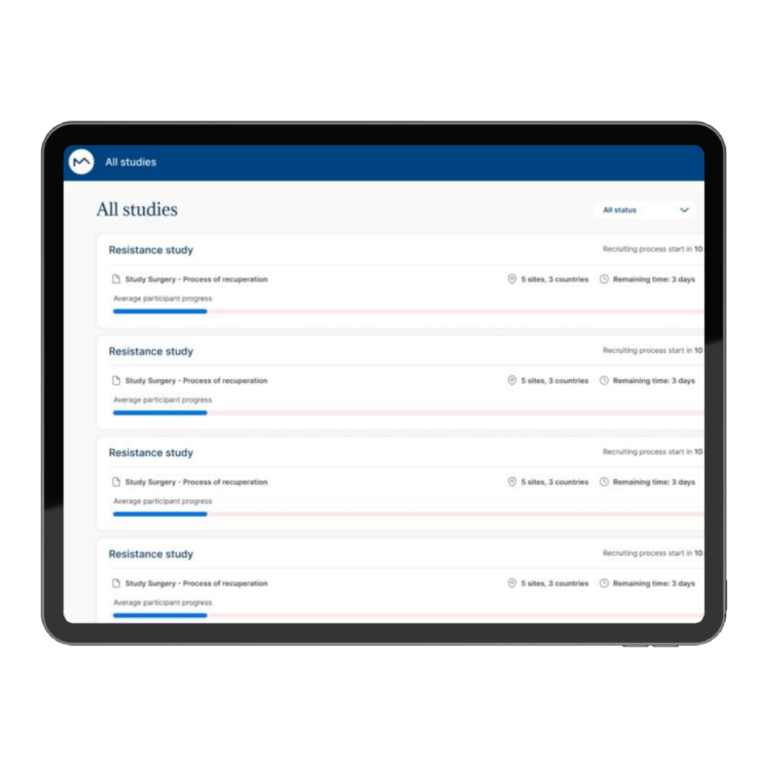

Streamline your study phases and save precious time with Milo's data analysis and visualization capabilities. Stored and pre-filtered views facilitate smoother transitions to subsequent clinical trials, accelerating future setups.

Direct feedback from patients is facilitated by ePRO, streamlining their participation in clinical trials. For instance, the reduced need for on-site appointments allows patients to effortlessly incorporate the upkeep of the electronic patient diary (eDiary, ePRO) into their daily routines.

Optimize your study kick-off with reusable study, workflow, and notification templates, all on a unified, cloud-based platform for seamless collaboration.

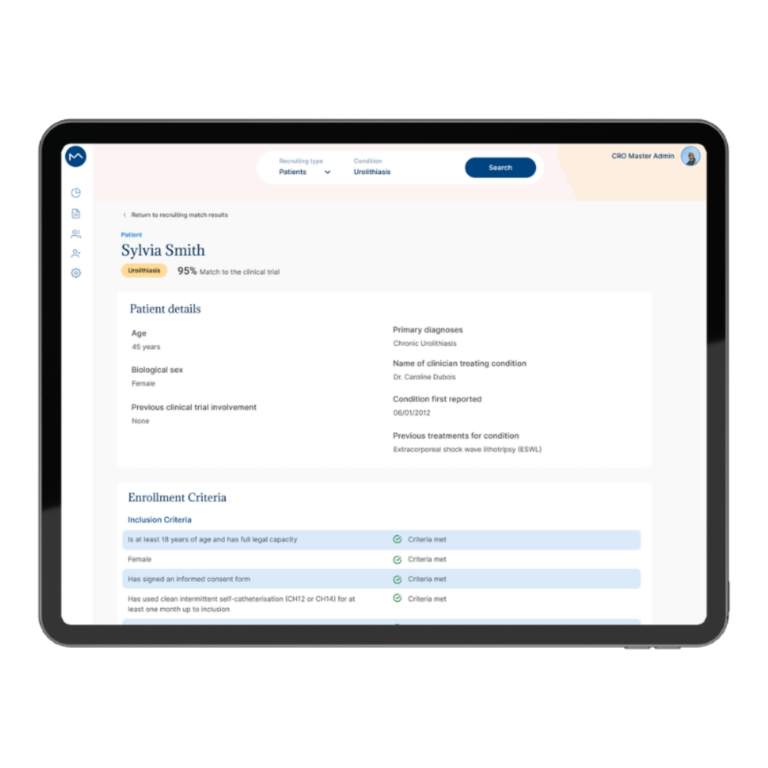

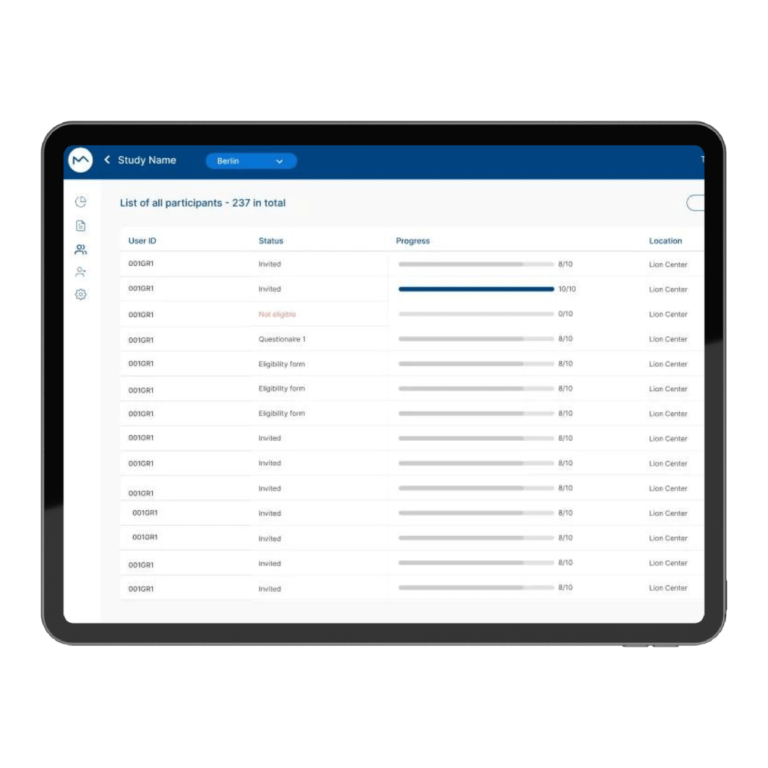

Speed up recruitment and onboarding using digital screening surveys and consent processes. Enhance global trial accessibility, boost participant retention, and reduce compliance errors with Total Consent.

Ensure trial participant engagement with offline accessibility, cross-platform TeleVisit scheduling featuring waiting rooms, reminders, notifications, and in-app help and support.

Cut down on data cleaning time and focus on swift, meaningful analysis. Unleash the potential of eCOA, Bring Your Own Device (BYOD), and integrated sensors in one powerful solution.

Gain immediate insights into data and participant progress using operational dashboards. Proactively prevent dropouts, identify trends early, and make well-informed decisions in real-time.

Trust MILO for a compliant, forward-looking solution that prioritizes both innovation and safety

Comprehending the best practices in clinical research is the best way to evolve and be updated to participate in the ever-transforming realm we are part

EDC (Electronic Data Capture) system is transforming the field of Medtech and clinical trials in an unparalleled way. This software solution allows medical device companies

The realm of clinical research has been deeply changed, mainly the way we collect and manage data, with the surge of Electronic Data Capture (EDC).

It’s paramount to keep the pace of preparation activities in Post-Market Clinical Follow-Up (PMCF) planning, since the MDR has drastically enhanced the bar for supporting

Products

Industry

Company

Legal & Compliance

Newsletter